Financial Alternatives built for private healthcare

Banking and financial services have always played an essential role in helping healthcare practices start, grow and even mitigate cash flow risk.

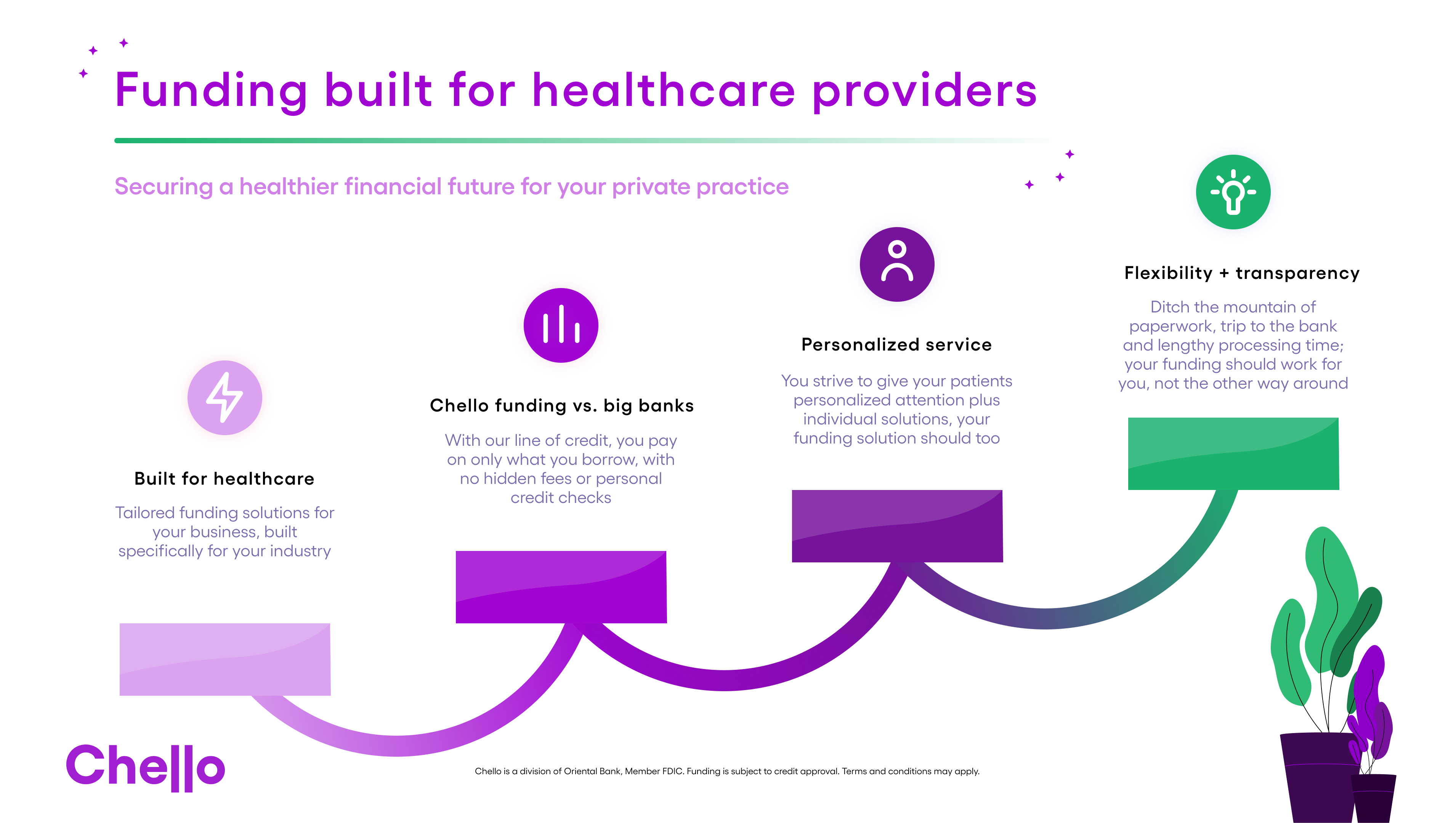

However, when it comes to small to mid-size practices, there are a few key reasons why larger financial institutions might not be the ideal choice. Let’s talk about some of the drawbacks of working with a big traditional bank and explore what alternatives may be better for your private practice.

1. Limited understanding of the healthcare industry

Large banks focus on serving a wide range of industries. This means they typically have a one size fits all solution for small and medium sized businesses. But, for many healthcare practices, this could be a problem, because it probably means a lack of specialized knowledge about the medical industry, and how your business runs. This could ultimately lead to challenges when seeking out tailored or personalized financial solutions for your business from one of these large financial institutions.

2. Lengthy loan approval processes

We get that starting or growing your own private practice is hard, and almost always requires financial assistance for practitioners. Whether it’s expanding facilities, investing in equipment or even just meeting capital or cash flow needs, funding is often an immediate need. Funding from big-traditional banks can be an option, but for a business who doesn’t have the luxury time or a dedicated financial department, the mountains of paperwork, extensive documentation requirements and lengthy processing times can be a significant hurdle.

3. Varying levels of personalized service

For small to mid-size businesses, personalized attention and individualized solutions are crucial. Who doesn’t want help? Large banks, however, can sometimes struggle to deliver the level of customized support smaller medical practices really need, which leaves medical practitioners finding it challenging to establish a genuine relationship with their big-name bank.

4. Higher fees and hidden charges

Often times, large banks can come with high fees and have sneaky, hidden charges. This might come in the form of increased maintenance fees, transaction fees, annual fees and other service charges that can really add up over time. For large healthcare institutions such as hospitals, these costs may be factored in, and are often expected. However, for smaller practices, or for practices just starting out, these additional costs can be especially problematic.

5. Lack of flexibility

In the ever-evolving healthcare landscape, small to mid-size medical practices frequently encounter changing financial needs. Whether it is adjusting payment terms, reevaluating a credit line, or accessing tailored financial solutions, during challenging times, large banks are often not agile enough to accommodate the specific requirements of medical practitioners.

Conclusion: Explore Chello’s Boost Funding Engine!

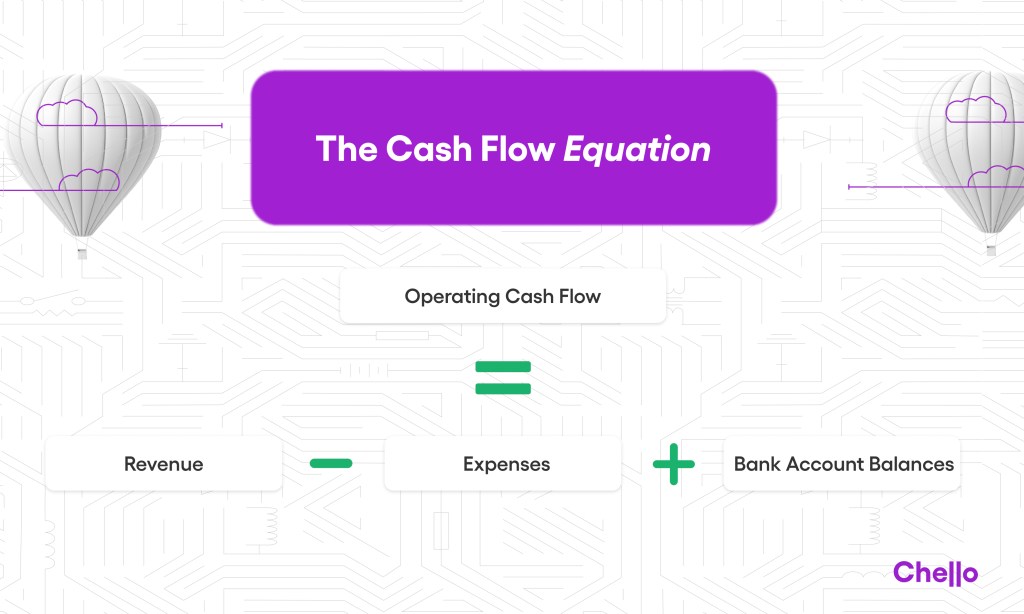

While large traditional banks may have some benefits for bigger corporations, their structure and non-personalized focus for smaller businesses often make them less suitable for small to mid-size medical practices. That’s ultimately why we built Chello, to fill this gap and create a bank funding solution that allows medical practitioners to enjoy a more personalized experience, with industry-specific knowledge and fast tailored funding delivered within a day. In addition to funding, Chello also provides healthcare professionals with a comprehensive financial snapshot that predicts cash flow downfalls, and lets users know when and why may be the right time to access funds.

Now that just feels better, doesn’t it?

*Subject to credit approval. Terms and conditions may apply. Chello is a division of Oriental Bank, Member FDIC.