Balancing act: Managing cash flow for medical practices

Managing cash flow well is essential for any business. But it’s especially important for medical practices. With unpredictable income it’s hard to know how much money you’ll have in the bank at any given time. Not sure why cash flow is such a big deal? We explain it all here.

Don’t worry, there are ways to forecast your cash flow and make sure your medical practice runs smoothly. Keep reading for tips, tricks, and tools*.

*Hint, hint. Our cash flow management engine, Chello, might be able to help!

Calculating cash flow in a medical practice

By now you’re wondering: how do I calculate cash flow for a medical practice?

Let’s start with a simple equation: cash flow is the net balance of cash inflows (revenue, or cash moving into your business) and outflows (expenses, or cash moving out of your business) for your business at a given point in time.

While this two-part formula looks quite simple, on a practical level, the sheer volume of invoices, bills and other paperwork piling up can make it difficult to actually calculate or predict your cash flow into the future. That’s why we created Chello - to help provide clarity amid chaos. (More on that later – now, let’s get into the nitty-gritty of what you can actually do.)

How to improve cash flow in a medical practice: High-impact tactics

Part 1: Ensuring healthy cash inflows

Make sure that you’re actually getting paid for your services

As most patients rely on insurance to help them afford medical treatments, your practice will most likely receive most of its inflows of cash from a third party. It’s not uncommon to have claim denials, underpayments, or lost claims due to mistakes when coding patients’ treatments. These errors can delay your payment and, in turn, cause cash flow problems. It’s worth taking some time to look at your payment situation to identify which payers are causing the most trouble. This may be an entire category of your payer mix, or an individual payer (i.e., one particular insurance company). Once you’ve identified them, you’ll need to investigate why these issues are happening. Working with a professional claims management provider can help. But you’ll also want to leverage automatic invoicing and paying systems wherever possible and train your staff to handle problematic payers when they arise.

Find the right payer mix for your practice

As you know, different payers -- government health plans, private insurance, or self-pay, have different repayment rates. Who’s paying is a major factor for how much cash you will receive from a particular service or patient – and when you will receive it. Therefore, managing your payer mix -- the percentage of patients with either government, private insurance, or self-pay – is an important step in managing your cash flow.

Streamline your scheduling

One of the most important aspects of managing cash flow in a medical practice is appointment scheduling. Make sure you’re making the most use of your staff’s time, and helping patients get in and out quickly. Are you letting patients book time themselves? Are you scheduling telehealth visits whenever possible? Can they do their intake forms digitally, on their own time? And are you saying “no” to no-shows? Send patients a reminder (even better if that can be an automated reminder), and make sure they’re incentivized to not miss their appointments if they don’t cancel with advanced notice.

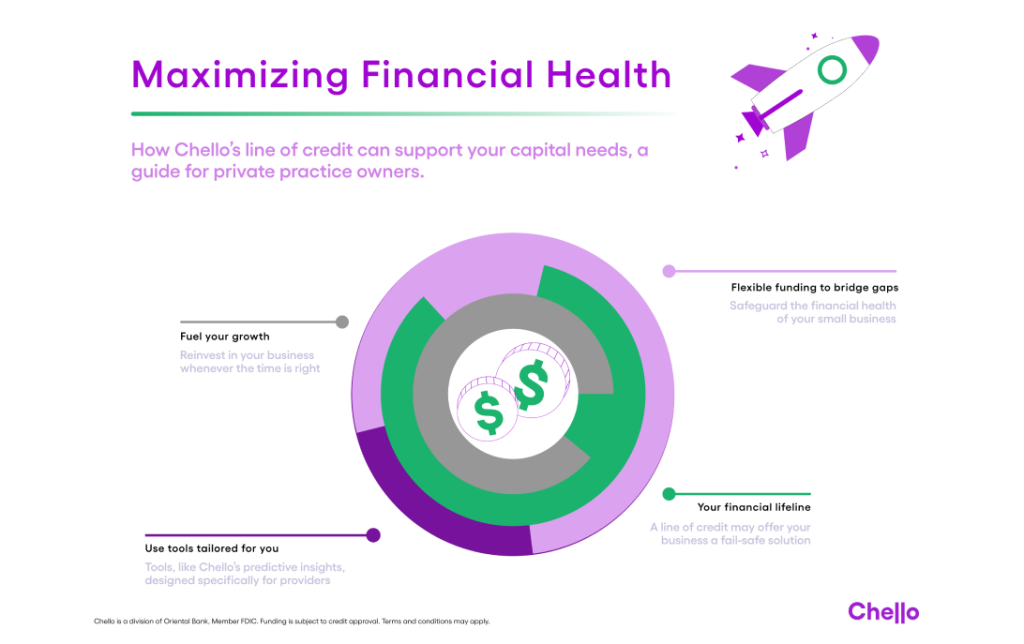

Use credit or funding solutions when you need them

When you predict a shortfall of cash, or need to finance a large expense, Chello offers a quick and easy solution. We call it our Chello Boost line of credit*. It’s built to help you get the funding you need at the time you need it.

Maintain a growth mindset

While it’s important to maintain consistent cash inflows, and to maximize the cash you get from what you’re already doing, it’s also important to find and act on opportunities to expand your reach and your revenue.

Part 2: Getting your cash outflows under control

Disperse your costs over time

The things you need to run a medical practice – especially the medical equipment can be costly. Equipment rental or financing programs can help you disperse this cost, giving you a bit of breathing room and predictability. And many of the leading tech services and tools you’ll need are available on a subscription basis.

Speaking of tech and tools…

Automate your routine operations

With today’s user-friendly tools, you don’t have to be a tech wizard to automate key process. There are tools and tech that will put onerous tasks on autopilot – like billing, appointment booking, and even reminders.

Centralize your operations

Last, but by no means least – make sure you have visibility of and control over what’s happening in your practice. Having it all available in a single dashboard helps in several ways. First, because you and your staff should not be spending time finding the information you need or spending money on redundant systems. Second, because medical practices are complex operations, with lots of different variables that affect your financial health. And that’s where we come in!

Chello helps you take control of your financial situation. We connect your bank accounts, accounting software and practice management platform, and bring your most important cash-flow data point into one, simple dashboard. Chello automatically starts a cash flow analysis for your practice, and supplements it with daily scoring & real-life, useful insights.

But we’re more than a useful dashboard. We’re human experts too! Imagine that you had an expert around to answer your questions. At Chello, you get just that – a personal advisor that is on call to help you. We’re experts in money matters AND the intricacies of your business.

Managing cash flow is essential for the smooth sailing of your practice but it shouldn’t take you away from what you really want to do. After all, you didn’t start a medical practice to become an accountant. With the right tactics and tools like Chello, you can make it a lot easier.

*Certain terms and conditions apply. Subject to Credit approval.