Maximizing financial health: Financial Tips for doctors and private practice owners

We know that owning a private healthcare practice goes way beyond patient care; it's also about ensuring that you maintain a robust financial foundation.

In this guide, we'll delve into a few essential financial tips and concepts tailored for private practice owners. We'll explore the significance of credit, the nuances of business capital and how Chello's innovative cash flow tools can empower your practice to thrive.

1. A Line of Credit can be your financial lifeline

A fail-safe solution

In the realm of financial management for private healthcare practices, having a reliable line of credit is akin to having a lifeline. It's a financial tool that safeguards your practice's financial health, bridging gaps when necessary.

Imagine this - it's the end of the month, and you're waiting for insurance reimbursements to trickle in. However, you have rent, staff salaries and suppliers to pay. A line of credit can bridge these cash flow gaps seamlessly, ensuring your practice remains operational even during lean months. One of our top financial tips for any doctor in private practice is to seriously consider establishing a line of credit.

Safeguard your financial health + bridge gaps with flexible funding

One key advantage of a line of credit is its flexibility. Unlike traditional loans, with a line of credit, you're charged interest only on the amount you actually use. This can lead to significant savings for your practice and reduce the financial burden of unnecessary interest payments.

2. Access capital to fuel your growth

Reinvest in your practice

Now, let's dissect the concept of capital. It's not just financial jargon; it's the lifeblood of your practice's financial health. Capital refers to the financial resources available to reinvest in your business, whether it's for new equipment, staff training or expanding your services for your patients.

Consider a scenario where a sudden equipment breakdown requires immediate repair. Your capital should provide the flexibility to address such unexpected expenses without disrupting operations, demonstrating the critical role of working capital in your practice's daily operations.

Fueling your growth can lead to substantial opportunities for your practice.

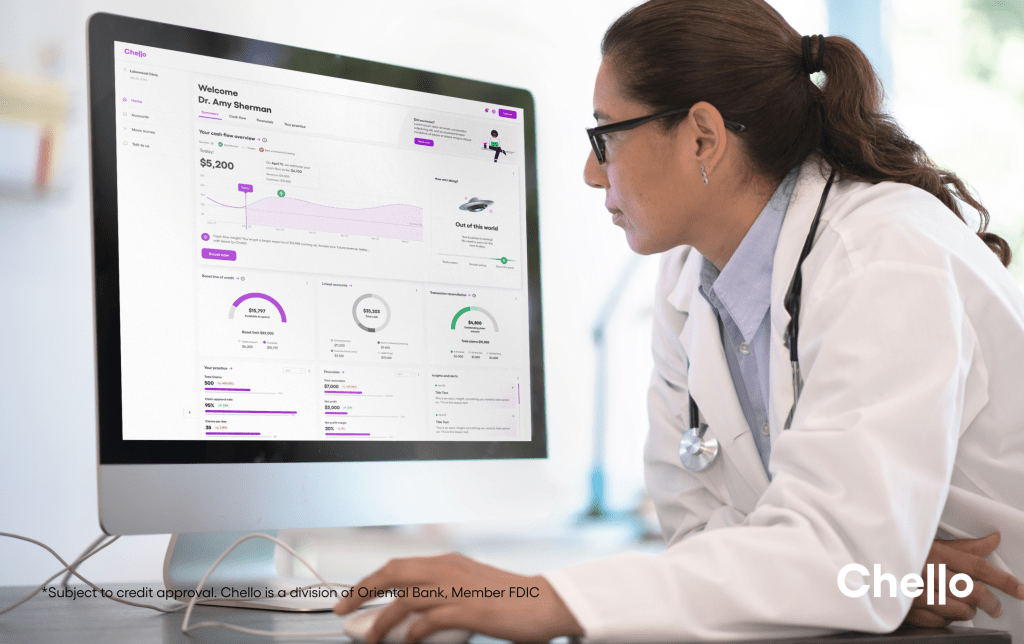

3. Use Chello as your financial ally

Tools tailored for you

Now that we’ve delved into the importance of credit and capital, let's talk about Chello and how using it, is a financial tip all on it's own. Chello's innovative cash flow tools are designed specifically for healthcare providers and private practices like yours.

Often, practices have multiple sources of disorganized financial data – it could be from bank accounts, accounting software and healthcare insurance claims and payment data -- and despite having the information, they don’t know how to answer easy questions, like, how am I doing today? With Chello, practices can automatically analyze cash flow needs, and understand why or when they may need to take action. Chello's funding engine* allows you to quickly boost your cash flow as required, reducing any risks associated with incoming bills or unexpected expenses. What a relief!

Data-driven decisions

Chello's daily insights and future projections are invaluable. They empower you to make informed decisions, anticipate cash flow challenges and ensure that your practice runs seamlessly.

In conclusion

In summary, private practice owners must be well-versed in their day-to-day financial situations to thrive. Chello’s line of credit offers financial flexibility, allowing you to borrow precisely what you need, reducing interest costs, and ensuring smooth cash flow all while layering in the powerful tools you need to access data-driven insights and solutions tailored for your practice.

With Chello at your side, you can shift your focus from number crunching to providing top-notch patient care. It's time to ensure that your practice thrives. Chello is the financial tool your practice needs to succeed in 2024 and beyond.

*Subject to credit approval. Terms and conditions may apply. Chello is a division of Oriental Bank, Member FDIC.