5 Real-Life Scenarios Where a Medical Practice Line of Credit May Rescue Your Business

5 Real-Life Scenarios Where a Medical Practice Line of Credit May Rescue You

As a doctor, you’re no stranger to the delicate balance between patient care and financial stability. Running a medical practice is like performing a high-stakes juggling act: you’re managing appointments, diagnoses, and treatment plans while also keeping an eye on the bottom line, the bottom line in which you may have not studied in medical school. But what happens when unexpected expenses or cash flow gaps threaten to disrupt your rhythm? Enter the unsung hero: the medical practice line of credit.

Before we peek at some real-life scenarios that we at Chello have heard come across healthcare professionals’ desks, let’s make sure we are on the same page about what a line of credit is.

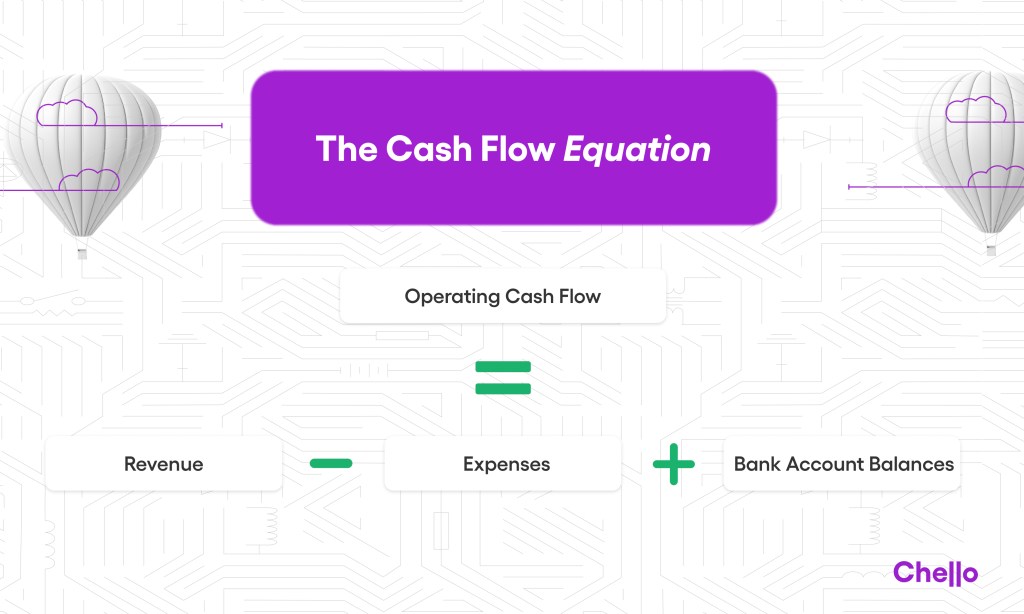

A line of credit is a type of borrowing arrangement offered by banks or other financial institutions that provides individuals or businesses with flexibility in accessing funds up to a predetermined limit. Unlike a traditional loan where you receive a lump sum of money upfront, a line of credit allows you to withdraw funds as needed.

1. The Emergency Equipment Upgrade:

In the intricate ecosystem of a medical practice, precision and reliability are two of the most important factors of a well-run business.

Your X-ray machine, a stalwart companion throughout countless diagnoses and treatments, suddenly signals its retirement by dying on you, mid-appointment. There’s a sense of urgency to replace the machine as practices cannot bill for procedures that they cannot follow through with. At the heart of the matter, if you don’t have the machines, you don’t have patients, and if you don’t have incoming patients, you don’t have a practice.

With all that known, it’s still a very frightening situation for a doctor to find his or herself suddenly in. The financial burden can loom large and it may not be the opportune time in the month to cover that large of an expense.

2. Staffing Shortages

When Your Receptionist, Nurse, and Admin Assistant All Decide to Take a Simultaneous Vacation

Picture this: you are a small private practice of just three providers and your receptionist is out sick, your nurse is on vacation, and your administrative assistant just handed in their resignation. Staffing shortages can cripple a medical practice faster than you expect. With a medical practice line of credit, you can hire temporary staff or cover overtime costs until your team is back at full strength.

As a doctor is likely to be working a demanding schedule, there is no way he or she would be able to tack on working the front desk, assisting in triage, or whipping up paperwork on top of all of that.

3. Seasonal Fluctuations

When Flu Season Hits Like a Category 5 Hurricane

Medical practices often experience seasonal ebbs and flows. During flu season, you’re swamped with patients; during the summer, it’s crickets. It’s like Mother Nature herself is playing a game of “Let’s Stress Out the Doctors.”

A medical practice line of credit acts as a financial safety net, allowing you to bridge the gap during slow months and keep the lights on. So when the waiting room resembles a crowded subway during rush hour, you’ll be prepared.

Consider your specialty and the ups and downs of your cash flow every year—if you know your cash flow may suffer during different times of the year, a medical practice line of credit may be the safety net you are needing.

And might we suggest ShiftMed, an on-demand workforce platform for those times when you are experiencing a ton of seasonal demand? They have a network of over 350,000 credentialed healthcare professionals.

4. Marketing Blitz

When You've Developed a Groundbreaking Treatment Protocol and Want to Shout It from the Rooftops (or at least Facebook)

You’ve cracked the code. Your treatment protocol is like the secret sauce that makes your medical practice stand out. But how do you spread the word?

A medical practice line of credit can bolster existing marketing efforts and can fund a marketing campaign that reaches beyond your waiting room. From targeted Facebook ads to print material to eye-catching billboards and streaming commercials, you’ll have patients appointments booked out for the next few years.

(Looking for inspiration on a marketing campaign for your practice? Check out some of these smart examples.)

5. Insurance Hiccups:

When Insurance Reimbursements Play Hide-and-Seek

From the research we have conducted at Chello, it takes on average 30-90 days of uncertainty (note the “un” prefix) for a private medical practice to get paid for their claims. And as most private practices accept a whole list of insurance providers, this can turn into both a big and essential part of your monthly cash flow. Insurance reimbursements are known to be slow and unpredictable, this is a given. Meanwhile, your bills keep piling up.

A medical practice line of credit ensures that your practice doesn’t suffer while waiting for insurance checks to arrive. It’s like having a financial safety net. Having a line of credit keeps the unwanted disruptions from happening and if someone at the insurance company decides to take their sweet time handling claims, it will be no sweat off your back.

There’s also a chance for medical billing denial altogether, which can happen for many reasons. For a more comprehensive look at what those may be, read here.

A medical practice line of credit is there when you need it and when you’re not using it, it is quietly supporting your practice’s financial health in the background. Next time you face a financial dilemma, don’t panic; just tap into that line of credit from Chello and keep saving lives.

Remember, this article isn’t just for the white coats—it’s for the scrubs, the stethoscopes, and the late-night coffee runs. Because when it comes to your medical practice, a line of credit isn’t just a financial tool; it’s a lifeline. If the time is now for a line of credit, sign up for Chello.