Medical Practice Loan Documentation: A Better Way?

Medical Practice Loan Documentation: A Better Way?

If you are a physician with a private practice and are contemplating applying for a loan, here is our first piece of advice. Prepare your medical practice loan documentation properly and prepare it ahead of time.

When seeking any form of financing—whether personal or business-related—you will be required to furnish a comprehensive set of documents that validate your identity and outline the nature of your practice. Lenders want to make sure you are fully able to pay back what they are willing to extend.

These records play a crucial role in facilitating approval from your chosen lender and can set you up for success but can also set you up for failure. While individual lenders may have unique application processes and eligibility criteria, the requested information generally aligns across the board.

By familiarizing yourself of what is required beforehand and getting your medical practice loan documentation in check, you’ll enter the loan application process better prepared and as a bonus, increase your chances of approval. A win-win. Let’s get into it.

With all that said, the perk of signing up for Chello is that by this stage in time, all of this information above will already be accessible to us via your linked bank accounts, accounting software, and any related healthcare specific platforms. There is minimum loan documentation required to get your practice set up with Chello. As a doctor or someone involved in private practice, we know this time-saving aspect can mean a lot.

Documents Required for a Medical Practice Loan

1. Personal Identification + Financial Information

This shouldn’t come as a surprise but your lender will need to establish your identity and make sure you are, in fact, a real person. Here’s what will be required of you:

- A valid government-issued photo ID (your driver’s license or passport will suffice).

- Your nine-digit social security number OR your Individual Taxpayer Identification Number (ITIN)

- A professional resume (this may not be needed, but always good to have on hand, especially if your venture is brand new)

- Personal Bank Statements from the previous year

They will also ask for the obvious like name, address, phone number, and date of birth. It’s advised that you have your personal bank statements from the past year handy, as well, as lenders may weigh your personal finances alongside your business finances.

2. Business Plan

A business plan is a piece of the medical practice loan documentation that you have a substantial say in. You can adjust, edit, and fine-tune your plan so that it accurately reflects what your practice represents. This is not a time to skimp. Your business plan is essentially a roadmap for your practice and should be clear, structured, and professional. Here are a few of the finer points that your business plan should include:

- A cover page that includes your practice’s logo along with a table of contents

- A value proposition

- An executive summary

- A company description

- A marketing strategy

- A comprehensive overview of your services

- Expense Projections

- Financial forecast

If any of the above seems to be out of your wheelhouse, there is always an opportunity to hire someone who specializes in creating healthcare specific business plans.

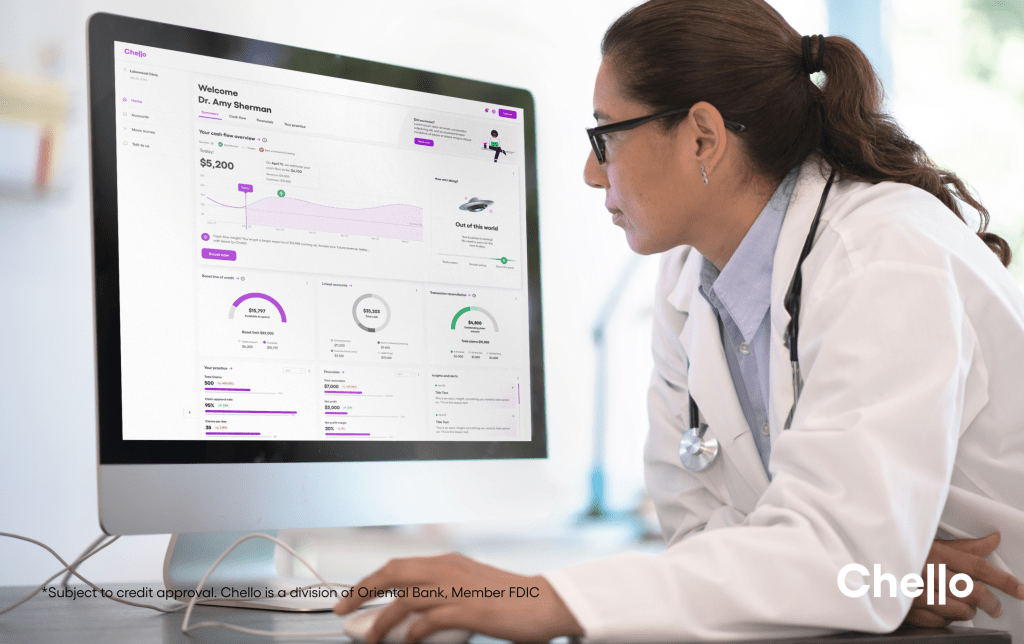

This seems like a lot, right? And it is. Chello, a fast funding software specifically designed for doctors, is revolutionizing the loan application process by eliminating the need for excessive documentation. Traditionally, applying for a loan as a doctor often requires an overwhelming amount of paperwork and documentation. This can be burdensome and time-consuming for doctors who are already juggling a hectic schedule.

Chello simplifies the process by streamlining the documentation requirements. With Chello, doctors can experience a much smoother and hassle-free loan application process. By eliminating the need for a ton of documentation, Chello saves doctors valuable time and effort, allowing them to focus on what matters most – providing exceptional medical care to their patients.

3. Private Practice Financial Documentation:

To demonstrate your practice's financial stability, be prepared to provide:

- A Profit and Loss statement that displays your practice's income, expenses, and net profit over a defined period.

- Balance sheet that presents your practice's assets, liabilities, and equity at a specific point in time.

- Tax returns that provide personal and business tax returns for the past few years.

- Bank statements that include recent statements from your business and personal accounts.

4. Licenses, Permits, and Certifications

When it comes to your medical profession, you likely understand the importance of various legal documents, business licenses, medical licenses, and registrations. The requirements for presenting these documents to your lender may vary depending on the specific type of medical practice loan you are applying for. Demonstrate your practice's compliance with all legal requirements by providing copies of:

- Medical licenses. You’ll want to include proof of your doctor's license and any additional certifications or specializations that you may have earned.

- Business licenses: Ensure you possess the necessary licenses and permits to operate a medical practice in your jurisdiction.

If it hasn’t been said before, we will say it again. Chello offers a distinct advantage of the traditional loan application process. We minimize the need for extensive documentation and enable doctors to save valuable times and lives! We eliminate the hurdles by streamlining the process and taking the “jumps” out of it.

5. Collateral (if required)

Your lender might ask you to provide security (collateral_ in return for a medical practice loan. This security is an asset that the lender could take possession of if you fail to repay the loan or miss payments for any reason. Some possible forms of security include physical assets such as:

- Cars

- Property

- Machinery

- Stock

Luckily, many medical practice loans do not mandate security (nor does Chello!) since you can use the office building or medical equipment being purchased as a form of guarantee so you may be in the clear with this one.