Onward and Upward: Make Your Medical Practice Thrive

Your new healthcare practice launched. What now? Here is your guide on how to grow your medical practice into something big.

Congratulations on taking the next step! It's a big step, and you must keep the momentum going. There were a lot of big decisions you considered at the beginning of your journey. For example, who would be on the team? Would you create a solo practice or a group practice? Which range of services would your practice include? There are now many more to answer. How to grow your medical practice is a good question to have as it means you are ready.

Remember – you did this for a reason! It’s essential to set yourself up for success in the early days and regularly ensure you're on track to achieve your goals. This can seem daunting at first, but it boils down to three critical success factors: maintaining consistency, seizing opportunities, and preparing for the unexpected.

How do you effectively manage those factors? Let's get into it.

Maintaining consistency

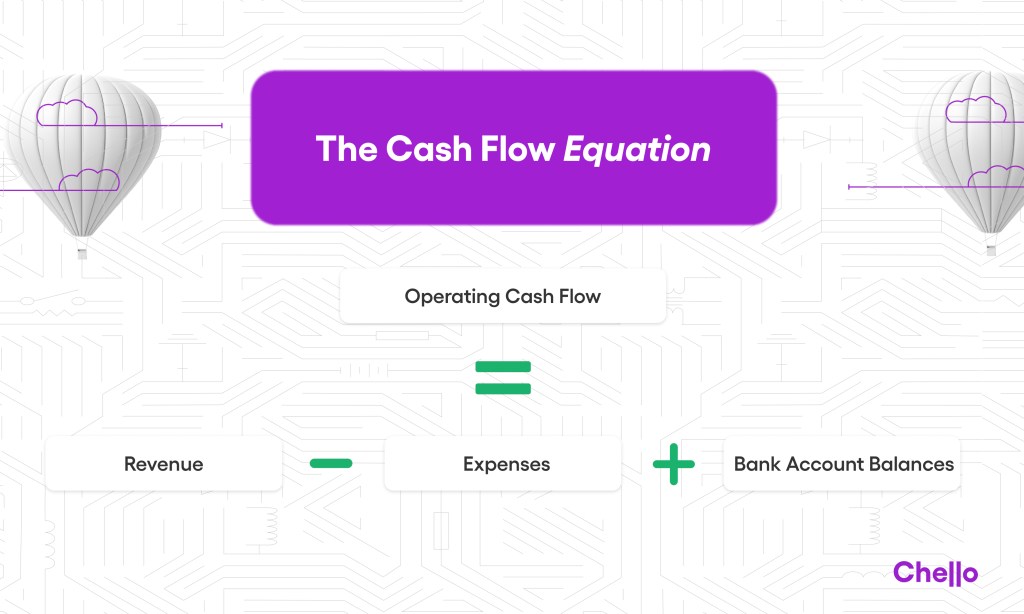

Consistent cash flow

Consistent and dependable cash flow is critical for your business's health and peace of mind. It's an everyday process to ensure that you have enough clients and personnel to fill appointment slots and maintain a consistent stream of revenue. On top of it all, you monitor your expenses: subscriptions, employee salaries, loan paybacks, bills, and more, to regulate your cash flow effectively. There are a lot of moving pieces in running a successful medical practice!

Chello helps you keep track of these numbers. We break down your financials on one simple dashboard. We answer the question of "How are we doing today," with our Daily Cash Flow Score, as well as allow you to see your 90-Day Forward View, where we accurately predict your cash flow for the next three months.

Consistent operations

Regardless of your practice specialty, the most critical early hire is an experienced office manager to run the day-to-day operations. If you haven't done so already, we highly recommend hiring an experienced medical practice manager. When interviewing, ask yourself the following questions to help determine if he/she is the right fit:

- Has the candidate demonstrated evidence of leadership skills in past roles?

- Does the candidate demonstrate patience?

- Does the candidate have any medical practice finance or finacial expertise?

- Does the candidate for medical practice manager communicate effectively in answering questions?

- Are they proficient in technology?

- Have they shown organizational skills?

With Chello in their back pocket, they've immediately got an edge: an instant and easy view into how your practice is running. They can quickly master the art of cash flow management and projection.

Don't forget that your other colleagues – not just your office manager – can use Chello, too. That means whoever you would like can see into the future of your business's finances. As a result, your whole team can stress less and focus more on your patients.

Seizing opportunities

To grow your business, you need to invest money back into it. It sounds simple, but this can be a daunting decision for many business owners. Knowing what to invest in and when can be extremely difficult when trying to figure out how to grow, let alone having the capital and flexibility to act as quickly when necessary. If you lack capital, you don't have to miss out. Instead, we recommend setting up a source of reliable, quick, and easy funding to help with any of the following investments:

- Technology and Infrastructure: From investing in a robust Electronic Health Records (EHR) system to integrating telemedicine into your services to purchasing new x-ray machines, all investments that will help grow your medical practice to the next level.

- Marketing: From a brand-new user-friendly website, to social media marketing, to sponsorships, or even a highway billboard, these efforts can help with practice promotion.

- Staff Development: From offering continued education opportunities to your team to bringing on new employees altogether, either option could be beneficial.

- Patient Experience Enhancement: From upgrades to your waiting room to a complete redesign of your operational workflow with a whole office renovation. Changing it up could increase overall staff efficiency and productivity.

- Community Engagement: From expos and health fairs and workshops, to partnering with local schools or business - all are worthy investments.

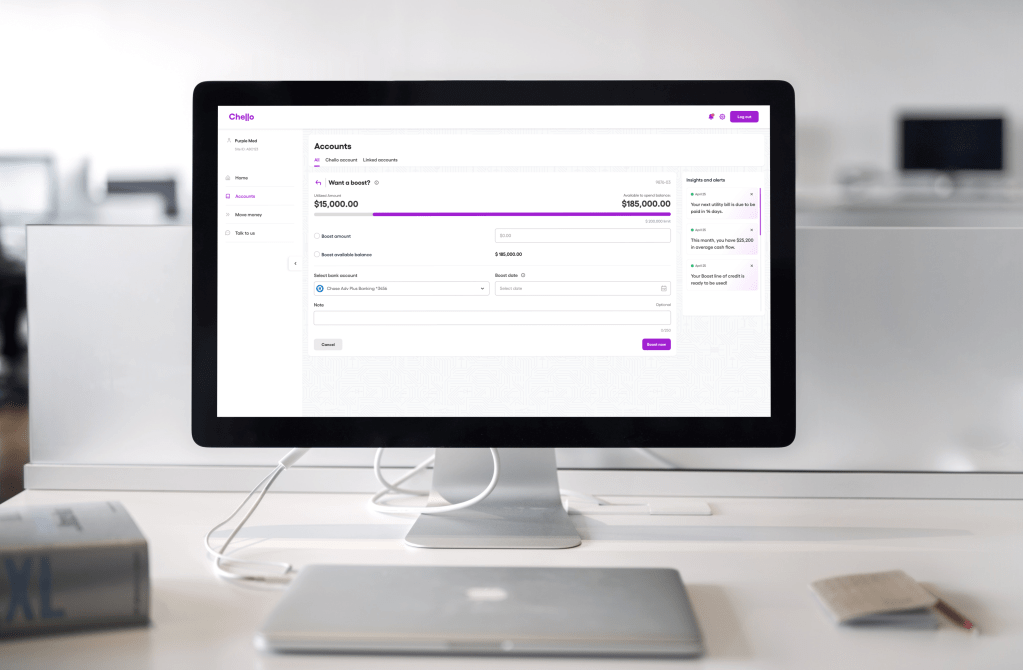

At Chello, our proprietary Boost Funding Engine* is personalized to your needs and completely flexible. But we don't stop there. Every business that signs up for our platform is assigned a dedicated relationship manager who understands you, identifies your needs and advises you on your next moves – big or small. So, if you ever get low on cash or simply want to invest more into your practice, our Boost Funding Engine will give you the money you need.

Preparing for the unexpected

Increased bills, broken machinery, earthquakes, security breaches with clearing houses … global pandemics. The world can be completely unpredictable when you're just starting out. But it doesn't have to be. You can – and you should – start protecting yourself from unexpected external factors. With Chello's predictive analytics, you can look into your financial future. If there's a shortfall on the horizon, we have your back.

Along with having your finances all squared away, it would be best practice to have in place an emergency preparedness plan, a health information technology backup, a diversified list of suppliers of your medical supplies, and an updated patient contact list. Being prepared and proactive is an effect strategy for how to grow your medical practice assuredly.

In summary, knowing your numbers is the key to all three success factors: maintaining consistency, seizing opportunities, and preparing for the unexpected.

Chello gives you clarity and control over your financial situation with a 90-day forward view, a detailed cash flow score, cash flow insights, and our Boost Funding Engine to ease any bumps. Because you shouldn't be wading through piles of paperwork – you should be focused on being a doctor!

*Subject to credit approval. Terms and conditions may apply. Chello is a division of Oriental Bank.