Money in, Money out: the starter’s guide to cash flow

Predicting your cash flow isn’t just about knowing what your bank balance will be next month. It’s about knowing how you could use it to your business’s advantage. Will you have extra cash? Can you invest in new tools, equipment, or people? Do you need to slow down your spending next month?

Fortunately, we have answers to these questions.

Why is cash flow important?

Have you ever asked yourself if you have ‘good cash flow’?

And have you ever wondered what that even means?

Chello is here to help you make sense of it all. Because with the best tools and management practices, you can make your cash do more for your business while also keeping some in the bank for a rainy day.

The basics: What is cash flow, exactly?

Let’s start with a definition.

Cash flow is the net flow of money in and out of your business.

At a basic level, having ‘good’ or ‘healthy’ cash flow means that you have more cash coming in than going out every month. In practical terms, healthy cash flow means that you have money to invest in new opportunities – now.

Business owners like you also often ask us: “Is cash flow the same as profit?” The two are closely-related, but cash flow is more important. Consider another definition:

Profit is the money left over after expenses.

So why is cash flow more important than profit? Because your profit figures don’t necessarily tell you whether those assets are usable or tied up at a given point in time. In other words, making a profit doesn’t necessarily mean that extra money can immediately be invested in something else. Still, it’s important to understand both so that you know where you stand and what your company is able to do. We can help with that.

Seeing the future: Why cash flow forecasting matters

Of course, as an entrepreneur, you want to know about cash flow so that you can make plans and take action. You need to know not only what your cash flow trends have been, but also what it will look like in the future. That’s why having accurate cash flow forecasts are extremely important.

Like a finance time machine, forecasts estimate your ‘money in’ and your ‘money out’ projected into the future. These predictions are typically based on past data, so, the more data and sources there are to analyze, the more accurate your predictions will be. Ultimately, it’s this information that can help you understand the right steps forward for your business.

For example… if you predict that you’ll have lower than usual cash flow because of outstanding claims or fewer appointments booked for the month, you know you’ll have to actively take steps to cut costs or generate more business that month. On the other hand, if you see that you have more cash flow than anticipated, you could consider which area of your business you want to reinvest in for growth. Additional staff? Updated equipment? Increased marketing? The world is your oyster.

Whatever your situation and whatever you decide, predicting your cash flow ahead of time, rather than being reactionary in the moment, can be the difference between success and failure.

Taking action: how to get started with managing and forecasting your cash flow

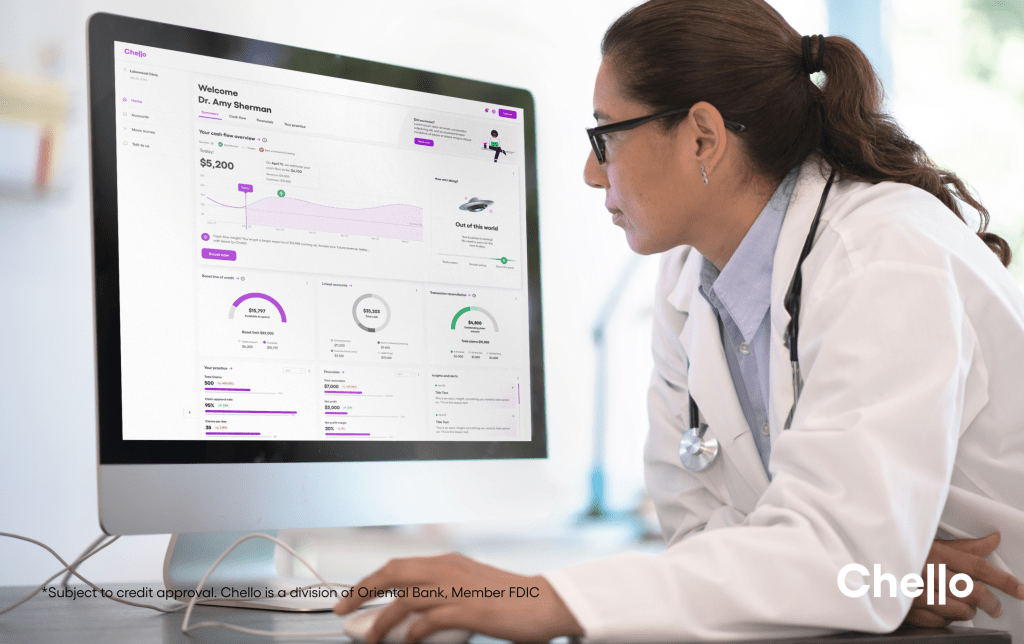

Trying to track your finances, improve your cash flow and find new opportunities all while balancing the other responsibilities that come with owning a business is stressful. We know because we’ve been there – and we created Chello with this exact problem in mind. Our cash flow dashboard and funding engine was built to do the hard work for you. How?

We help you see into the future

Chello’s automated cash flow projections allow you to see 90 days into the future with precision accuracy because not only do we bring together your banking and accounting data, but we also add your industry platform data source into the mix. This also allows us to deliver more accurate insights and recommended actions for your business so you know when it’s a good time to invest in your workforce, equipment, marketing or more.

We let you borrow instantly, in good times or bad

To ensure you are able to take action on your cash flow insights, we created the Chello Boost line of credit* to help you easily and quickly get the funding you need. Whether you want to invest in your company’s growth, or you need help through a shortfall in income, we're here. Chello’s intelligent engine has the ability to unlock just the right amount of funding to fuel your business growth. So you can worry less and thrive more.

We connect you to personalized, human guidance

Imagine you had an expert advising you whenever you need them. Someone who understands finance but also knows the intricacies of your business. At Chello you get just that – a personal advisor (we call them a relationship manager) that is on call to help you. There’s even more you can do to improve your business’s cash flow. For a deeper dive into best practices for boosting your company’s income and controlling costs, read here.

It’s true: cash flow is king. But we know you didn’t go into business to be an accountant. At Chello, we’re on a mission to help small- and medium-sized businesses thrive in the modern world. Let us help you build a healthy business, so you can get back to what you do best.

*Certain terms and conditions apply. Subject to Credit approval.