A Physician’s Guide to Medical Practice Funding

Medical Practice Funding

Being your own boss and opening a practice can sound like a dream. You’re in control of your time, you build close relationships with patients, you get to decide who you work with – but without learning how to run a successful business, this dream can turn into a nightmare. That is where medical practice funding, also commonly interchanged with medical practice 'financing,' enters the picture.

Medical practice funding (also known as medical practice loans, physicians loans, or medical practice financing as stated above) is a variety of business financing available to practicing medical professionals to offer medical professionals the funding to start to grow their practice. This funding can cover the costs associated with opening a practice, expanding a practice, buying equipment, covering payroll, and beyond. It can be a lifesaver in times of need and before times of need.

One of the first things you’ll need to consider is how to secure an ongoing, reliable source of medical practice funding. As mentioned, you may need this for office spaces, medical equipment, staff salaries and more as you get up and running. Too often a reliable source of medical practice funding is not available - or not feasible - especially at the moment when you need it. Doctors tend to be reactionary instead of proactive which is perfectly justifiable seeing that their main priority is and should be their patients.

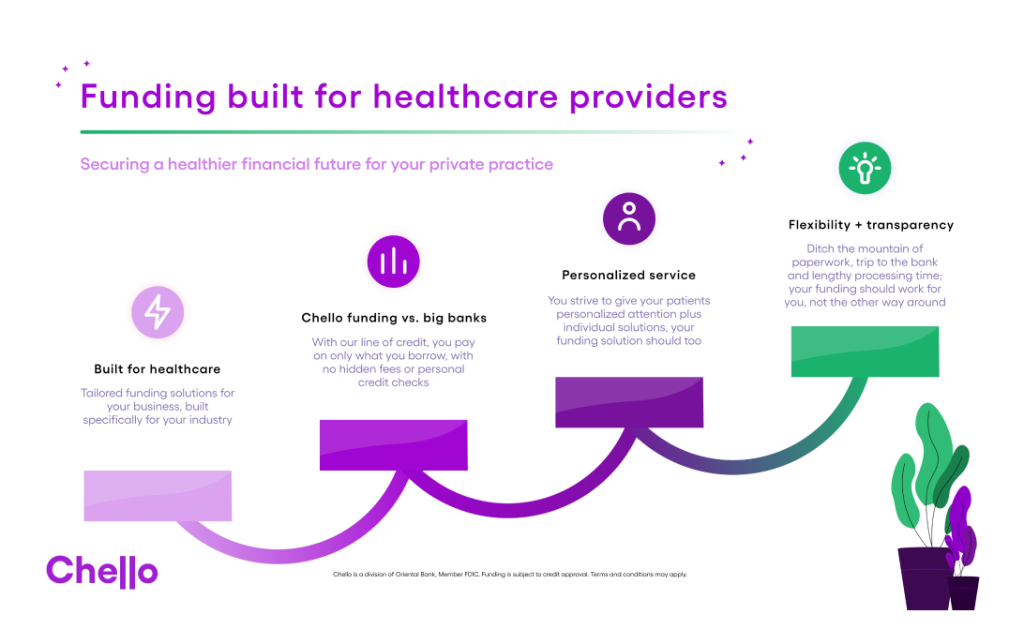

But speed and reliability are two key reasons we created Chello - and how we eliminate the headache of searching for medical practice financing. We want small to medium sized private practices to thrive.

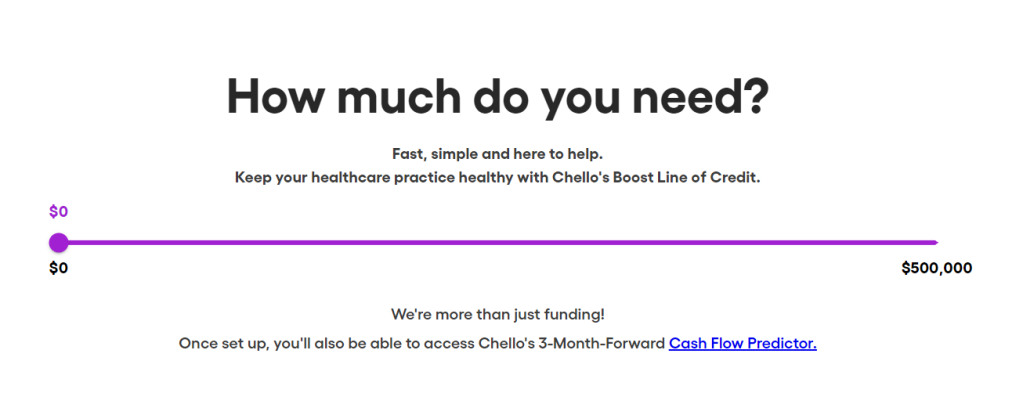

To help you on your journey, we’ve outlined some of the financing options available to physicians, including the Chello Boost line of credit*, which is personalized for each of our customers based on their real data.

(And if you are interested in figuring out right now how much you could possibly be approved for, answer these few questions.)

In this Article:

- Understanding What Medical Practice Funding Is

- How to Get Medical Practice Funding

- Bank Loans as an Option for Medical Practice Funding

- Chello Boost Line of Credit as an Option

Understanding Medical Practice Funding and Financing

Medical practice funding, often referred to as physician loans or medical practice loans or financing, serves as the financial backbone for healthcare professionals. It empowers you to embark on your own practice journey or elevate an existing one. The flexibility of these funding options allows you to tailor them to your specific needs. This funding provides you quick access to working capital, which can be essential when you are trying to keep a practice afloat.

The total financing available hinges on your unique use case and what you may need to provide in terms of collateral can also depend on the specific lender. While some lenders offer modest loans around $25,000, others extend substantial amounts, reaching up to $5 million. Your practice’s vision and requirements shape the loan size.

As a first step, you should be aware of the variety of funding options that are available for medical practices and see what sort of funding makes the most sense for you.

How to Get Medical Practice Funding

Securing funding for a medical practice funding can involve a lot of steps and it is best to familiarize yourself with what is required before you start the process.

- Assess Your Financial Needs: Determine how much funding you require for your medical practice. Consider expenses such as leasing or purchasing office space, equipment, staff salaries, utilities, and marketing.

- Create a Business Plan: Develop a comprehensive business plan outlining your practice's mission, services, target market, revenue projections, and expenses. A well-structured business plan is essential for convincing lenders or investors of the viability of your practice.

- Research Funding Options: Explore various funding sources available to medical practices, all detailed below in the next section.

- Prepare Financial Documents: Gather essential financial documents, including personal and business tax returns, bank statements, profit and loss statements, and balance sheets. These documents demonstrate your practice's financial health and repayment ability.

- Apply for Funding: Once you've identified the best medical practice funding option for your practice, submit loan applications or pitch your business to potential investors. Provide all required documentation and be prepared to answer any and all questions.

- Negotiate Terms: If you receive funding offers, carefully review the terms and conditions, including interest rates, repayment schedules, collateral requirements, and any associated fees. Negotiate terms that align with your practice's financial goals and capabilities.

- Secure Funding: Once you've finalized terms and agreements with a lender or investor, sign the necessary paperwork to secure funding for your medical practice.

- Manage Funds Wisely: Use the funds responsibly to fulfill your practice's financial obligations and achieve your business objectives. Keep financial records up-to-date and monitor your practice's performance to ensure you can repay whatever you borrowed.

- Seek Professional Advice: Consider consulting with financial advisors, accountants, or attorneys specializing in healthcare to navigate the complexities of medical practice financing and ensure compliance with regulations. There is no shame in seeking alternate advice.

Types of Medical Practice Funding/Financing

Bank Loans

Other than asking family members to shell out some money, this option is likely to come to mind first when you first when you consider medical practice funding options. To receive a loan for your practice you can apply for a medical business loan. Rates vary depending on the size of the loan you’re seeking and your credit history.

These medical practice loans are very unique as they take into account the doctor's financial backgrounds. They are different from a broad bank loan that anyone could be applying for. The downside? Getting approved for these sorts of loans from big banks like Bank of American or Wells Fargo can take weeks and is never guaranteed.

Besides medical practice loans from traditional banks, there are also Small Business Administration Loans (SBA 7(a) loans), Equipment Financing, invoice factoring, and term loans that fall under this category.

Small Business Administration Loans

For small business administration loans, you apply for funding from a traditional lender (i.e. bank or credit union) and the SBA guarantees your loan up to 85%[1]. The good news is, this reduces your rates and fees. The bad news is, the application process can take up to 4 months and requires extensive paperwork with no guarantee of approval.

The organization (SBA) collaborates with lenders who offer small business loans, acting as a guarantor for a portion of the loan. This arrangement serves as an insurance policy for the lender, encouraging them to extend loans to eligible businesses.

Qualified borrowers can access funding of up to $5 million through the 7(a) loan program. The interest rates are competitive and akin to term loans. Importantly, you have the flexibility to utilize the loan proceeds for virtually any business need you may have.

However, it’s essential to note that SBA 7(a) loans primarily target established businesses that are in good standing when it comes to their financials. If you’re a recent medical school graduate planning to start your practice, pursuing this type of loan might not be the right option for you as you are fresh out of the gate.

Benefits of an SBA Loan:

- Usually lower interest rates

- Elevated borrowing limits

- Relatively flexible repayment terms

Downsides of an SBA Loan:

- The application process can be long

- Lots of paperwork is needed

- Not an option for every physician

Equipment Financing/ Secured Loans

If you need to buy expensive medical equipment like machines, lab equipment, exam tables, wheelchairs and more, ‘equipment financing’ can be a good option. The equipment itself serves as collateral and the duration of the loan will match the equipment’s lifespan. You may also be asked to make a down payment too. This loan could cover the cost of essential items like exam tables, computer software, or specialized equipment unique to your branch of medicine.

Benefits of Equipment Financing:

- Doesn't require any collateral

- Easy qualification

- Easy alternative to leasing

Downsides of Equipment Financing:

- Restricted to only equipment

- High interest rates possible

- Secured by existing medical equipment

Term loans

Term loans for practices provide a lump sum of capital upfront, usually at fixed interest rates, allowing flexibility in its utilization for your business needs. Short-term loans generally require repayment within 12 months, while long-term loans extend repayment periods to five years or more. These loans often offer favorable interest rates to doctors with strong credit scores, along with predictable repayment plans. However, it's important to note that the borrowing limit for term loans might be lower compared to medical practice loans.

Qualification requirements may vary from lender to lender but generally include debt-to-income ratio and credit score.

Benefits of a Term Loan:

- Easier to qualify for than a bank loan

- Could be specific to healthcare

- Fast approval

Downsides of a Term Loan:

- Can be more expensive than bank loans

- Inflexible repayment schedules

Invoice Factoring

Invoice factoring is a financial arrangement where a business or practice sells its accounts receivable to a third party, known as a factor, at a discount. This provides the business with immediate cash flow instead of waiting for clients to pay their invoices. For a doctor, invoice factoring could be a practical funding solution, especially in cases where insurance companies or patients take a significant amount of time to settle their bills. By selling their unpaid invoices to a factoring company, a doctor can access quick capital to cover operational expenses such as staff salaries, equipment maintenance, or expansion plans. This allows the doctor's practice to maintain a steady cash flow and focus on providing quality healthcare services without being constrained by delayed payments.

Benefits of Invoice Factoring:

- Cheaper and easier than a bank loan

- You are in control of which invoices to fund

- Immediate access to cash

Downsides of Invoice Factoring

- Can be hard to exit the agreement

- More costly than traditional bank financing

- Confidentiality risk

Chello "Boost" Line of Credit

The Chello platform offers you funding from day one*. Unlike bank loans, our line of credit (‘Boost’), another type of healthcare or medical practice funding option out there, offers true flexibility. This means that if you run into fluctuations in your cash flow, you’ll still be covered. A line of credit for a medical practice is a revolving line, meaning that instead of getting a big chunk of money all at once, you have a credit limit you can draw against as needed. It’s almost like having a business credit card and you only pay monthly interest on the actual funds that you are using.

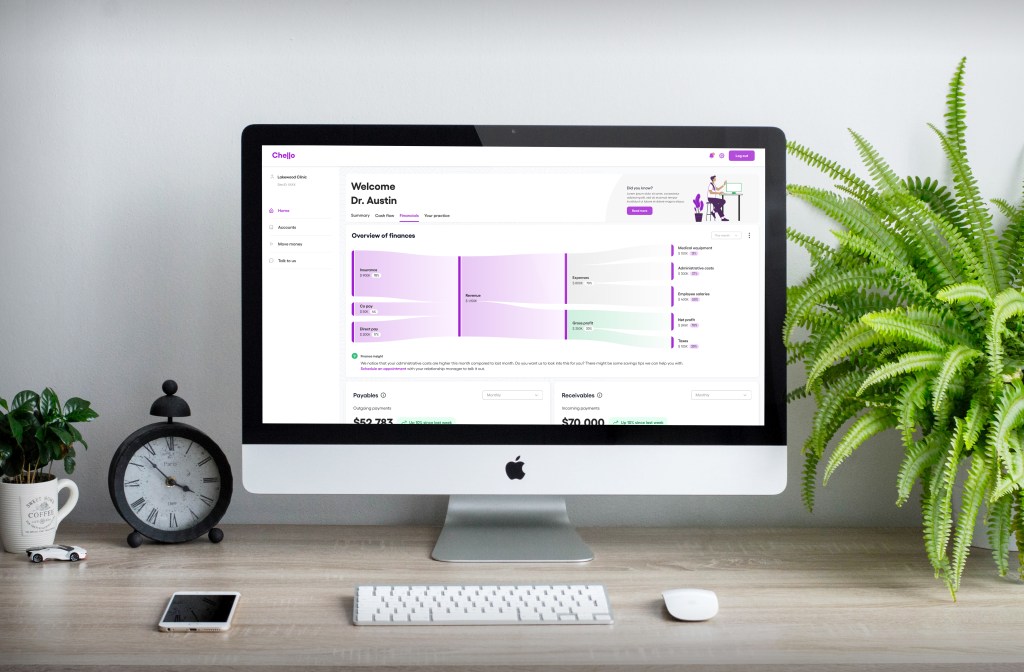

But this line of credit option doesn’t stop there. Our intuitive financial engine seamlessly connects the data from your existing bank accounts, accounting software, and industry-specific platforms. The result? Automated cash flow management, easy access to our Boost line of credit*—and daily, personalized insights built to turbocharge your practice’s business performance. Our interactive dashboard brings everything together, to provide a daily cash flow score and give you your most important financial datapoints all in one place.

Perks of Choosing a Line of Credit as Your Medical Practice Funding Option:

- Flexible Borrowing: Unlike traditional loans with fixed amounts, lines of credit allow those in healthcare to borrow as needed up to a set limit.

- Tailored Use Cases: doctors can use the funding in a variety of ways from operational costs to facility expansion.

- Financial Agility: with a line of credit, doctors have immediate access to funds. For physicians who run their own practice, without extra time on their hands, this is crucial.

- Cash Flow Management: a line of credit can you help you if you were to incur any unexpected dips in cash.

- Interest Control: Interest starts accruing only when you start borrowing and repayment terms are flexible.

While each of these funding options has its advantages, and there are many others, Chello’s unique ‘Boost Now’ capability makes funding easy and is a great way to achieve peace of mind, knowing that someone has your back.

With Chello, you get much more than just funding. You get a platform that streamlines your finances, insights that take your performance to the next level, and advice from real people that have your best interest at heart. Join the movement and sign up to Chello today.

[1] https://www.physicianspractice.com/view/six-medical-practice-funding-and-physician-business-loan-options

*Certain terms and conditions apply. Subject to Credit approval.